Loading...

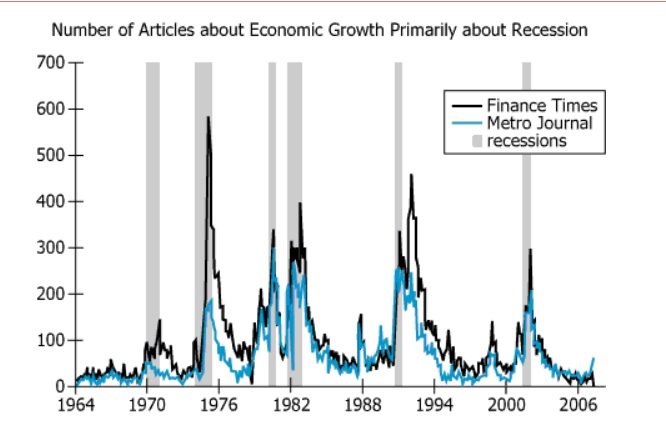

Recessions, broadly defined, are periods of negative economic growth, whereas expansions are periods of positive economic growth. The graph shows data about two leading newspapers—the Finance Times and the Metro Journal—and the number of stories per month in each about economic growth that were primarily about recession. It also shows when economic recessions occurred in the nation where the newspapers are based.

For each of the following, use the drop-down menu to create the most accurate statement on the basis of the information provided.

| Text Component | Literal Content | Simple Interpretation |

|---|---|---|

| Economic definitions | Recessions, broadly defined, are periods of negative economic growth, whereas expansions are periods of positive economic growth. | Recession = shrinking economy; Expansion = growing economy |

| Newspapers covered | The graph shows data about two leading newspapers—the Finance Times and the Metro Journal. | Comparison of two major newspapers |

| What's measured | Number of stories per month in each about economic growth that were primarily about recession. | Monthly count of recession-focused articles |

| Additional context | It also shows when economic recessions occurred in the nation where the newspapers are based. | Official recession periods are highlighted on the graph |

| Chart Component | What's Shown | Interpretation |

|---|---|---|

| Time period | 1964-2007, monthly data | Covers multiple economic cycles over 43 years |

| Y-axis scale | 0-700 articles per month | Tracks article volume focused on recession |

| Finance Times (black line) | Higher peaks (up to ~600 during recessions) | More intense coverage of recessions |

| Metro Journal (blue line) | Lower peaks (up to ~300 during recessions) | Less intense coverage, but still responsive |

| Grey shaded areas | 9 recession periods are highlighted | Spikes in article counts align closely with official recessions |

| Between recessions | Both lines drop to very low numbers | Minimal coverage of recession during expansions |

Suppose the number of stories per month in the two newspapers about economic growth that were primarily about expansion tends to increase steeply and steadily after a recession ends and to decrease sharply when a recession begins. Then, during the period shown on the graph, one might reasonably expect the number of stories about economic growth primarily about expansion to have been highest in ___.

If, from 1975 to 1976, the Finance Times had fewer stories overall about economic growth than the Metro Journal did, then most likely the Finance Times also had fewer stories ___ than the Metro Journal did.

Question 1 requires understanding when coverage about expansions would peak—specifically, at the end of the longest expansion, which is the year 2000. Question 2 relies on using given totals and visible recession coverage to deduce that the Finance Times must have had lower expansion article counts than the Metro Journal during 1975-1976.

The two questions are independent: the first is about timing across the entire period, the second is about story composition between two newspapers in a specific year. Solving one does not require knowing the answer to the other.