Loading...

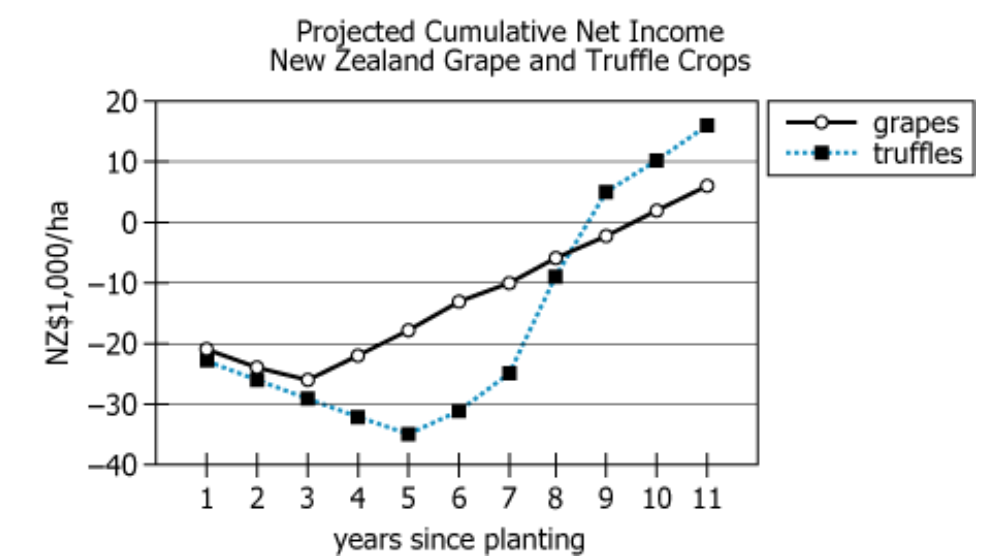

In New Zealand, the grape is a long-established crop, but the truffle—an edible fungus that grows on the roots of certain trees—became a commercial crop in the 1980s. The graph represents projected cumulative net income for grape and truffle crops through the end of the year, in thousands of New Zealand dollars per hectare (NZ$1,000/ha), for each of the first 11 years since planting. Cumulative net income is equal to total revenue from crop sales for the years since planting minus total investment costs over those same years.

From each drop-down menu, select the option that creates the most accurate statement about these projections based on the given information.

| Text Component | Literal Content | Simple Interpretation |

|---|---|---|

| Geographic Context | In New Zealand | The data represents farming in New Zealand |

| Crop Type 1 | the grape is a long-established crop | Grapes have been grown for a long time in New Zealand |

| Crop Type 2 | the truffle—an edible fungus that grows on the roots of certain trees | Truffles are valuable fungi cultivated on tree roots |

| Truffle History | became a commercial crop in the 1980s | Truffles are a newer commercial crop in NZ |

| Graph Content | projected cumulative net income | The chart shows predicted profit or loss over time |

| Units | thousands of New Zealand dollars per hectare (NZ$1,000/ha) | Values are in thousands of NZ dollars per hectare |

| Time Period | first 11 years since planting | Covers years 1 through 11 after planting |

| Net Income Definition | total revenue from crop sales for the years since planting minus total investment costs over those same years | Cumulative net income = total income minus total costs from year 1 to current year |

| Chart Component | What's Shown | What This Tells Us |

|---|---|---|

| Chart Type | 2-series line chart for 11 years | Shows grape and truffle investments over time |

| X-axis | Years since planting (1-11) | Progression after planting each crop |

| Y-axis | NZ$1,000/ha (from -40 to 20) | Tracks profit or loss per hectare |

| Grapes | Black solid line, starts at -21, ends at +6 | Grapes start with losses but recover steadily |

| Truffles | Blue dotted line, starts at -23, reaches -35 at year 5, ends at +16 | Truffles have deeper early losses, but end far higher |

| Break-even | Both cross above zero around years 9-10 | Profits only appear late in the investment |

| Growth Pattern | Grapes: steady linear rise after year 8; Truffles: large dip until year 5, then quick gains | Grapes are reliable; truffles involve more risk, but potentially higher reward |

Cumulative net income from truffles is least at the end of the [BLANK] year since planting.

What is needed: At which of these years (3rd, 5th, or 7th) is the truffle line at its minimum value?

If cumulative net income for grapes continues to grow at the same rate as in years 8 through 11 since planting, the cumulative net income from grapes for the 12th year since planting will be approximately NZ$ [BLANK] per hectare.

What is needed: What will the cumulative net income from grapes be in year 12 if the recent trend continues?

For blank 1, we found the truffle cumulative net income was lowest at the end of year 5. For blank 2, by continuing the consistent growth in grape income, we calculated year 12's grape cumulative net income as NZ$10,000 per hectare.

Each question focuses on a different crop and uses a different type of reasoning—one is about historical minimum for truffles, the other is about projecting grapes' growth. They are independent.