Loading...

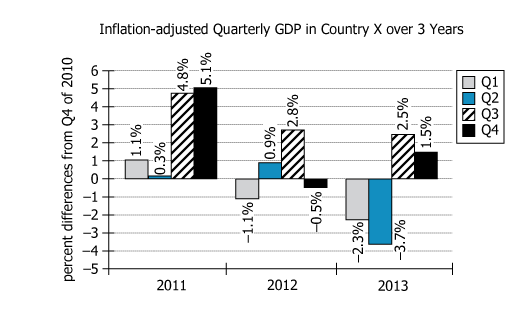

For 3 years of economic volatility in Country X, an economist tracked quarterly gross domestic product (GDP). The graph shows the percent differences in the inflation-adjusted euro value of the quarterly GDP from its level in Quarter 4 of 2010. For example, the graph shows the inflation-adjusted GDP for Quarter 2 of 2012 as 0.9% greater than the inflation adjusted GDP for Quarter 4 of 2010. The graph also shows the inflation-adjusted GDP for Quarter 1 of 2012 as 1.1% less than the inflation-adjusted GDP for Quarter 4 of 2010.

Select from the drop-down menus the options that create the most accurate statements, based on the information provided.

| Text Component | Literal Content | Simple Interpretation |

|---|---|---|

| Time period | 3 years of economic volatility | The data spans three unstable economic years. |

| Location | Country X | The country's identity is unspecified, labeled as 'Country X.' |

| What was tracked | Quarterly gross domestic product (GDP) | GDP was measured every quarter. |

| Measurement type | Percent differences in inflation-adjusted euro value | Changes are shown as percent differences, accounting for inflation, in euros. |

| Reference baseline | From its level in Quarter 4 of 2010 | Every data point is compared to the GDP value in Q4 2010, set as the reference \(\mathrm{0\%}\). |

| Example: Q2 2012 | GDP for Q2 2012 is \(\mathrm{0.9\%}\) greater than the GDP for Q4 2010 | In Q2 2012, GDP was up \(\mathrm{0.9\%}\) compared to the baseline. |

| Example: Q1 2012 | GDP for Q1 2012 is \(\mathrm{1.1\%}\) less than the GDP for Q4 2010 | In Q1 2012, GDP was down \(\mathrm{1.1\%}\) from the baseline. |

| Chart Component | What It Shows | What This Means |

|---|---|---|

| Chart type | Grouped bar chart (4 bars per year, 3 years, total 12 bars) | Allows comparison by year and by quarter |

| Y-axis scale | Percent differences from Q4 2010 ranging from \(\mathrm{-5\%}\) to \(\mathrm{+6\%}\) | Positive values show growth, negatives show decline |

| X-axis/Legend | Years (2011-2013), quarters differentiated by patterns/colors | Patterns help track individual quarters across years |

| Labels | All bar values are shown | No estimation needed; precise values are given |

| 2011 data | \(\mathrm{1.1\%, 0.3\%, 4.8\%, 5.1\%}\) | All quarters above baseline; strong and improving growth |

| 2012 data | \(\mathrm{-1.0\%, 0.9\%, 2.0\%, -0.5\%}\) | Mixed: alternating declining and growing quarters; signals emerging volatility |

| 2013 data | \(\mathrm{-2.3\%, 2.5\%, 1.5\%, -3.7\%}\) | More extreme swings; two quarters below, two above baseline; largest drop in Q4 2013 |

In the period 2011-2013, according to the graph, the inflation-adjusted euro value of quarterly GDP was least in [BLANK].

What is needed: The quarter from 2011–2013 with the most negative percent difference from Q4 2010 GDP.

To the nearest \(\mathrm{0.1\%}\), the median of the percent differences, as shown in the graph, in the inflation-adjusted euro value of quarterly GDP in the period 2011 - 2013 is [BLANK] percent.

What is needed: The median percent difference among all 12 quarterly values, rounded to the nearest \(\mathrm{0.1\%}\).

Reviewing all percent differences for quarterly GDP in 2011–2013, the least value appears in Q2 of 2013 (\(\mathrm{-3.7\%}\)). Sorting the 12 differences and averaging the 6th and 7th values gives a median of \(\mathrm{1.0\%}\), rounded to the nearest \(\mathrm{0.1\%}\).

These two questions are independent: one requires identifying the minimum, and the other calculating the median, with no steps or results needed from one to complete the other.